Anti-Poverty Tax Credits: Increase Financial Stability for Vermont Families

Tax Credit (EITC) help families with the fewest resources fill the gap between income and expenses by providing cash when they file their taxes. During the pandemic, temporarily expanded federal tax credits helped bring 10,000 people out of poverty. Unfortunately, when these credits ended, many Vermont families with children were worse off. Vermont has been a leader in state-level anti-poverty tax credits, but restrictions on who qualifies, as well as systemic barriers to access, leave out many Vermont families who would benefit from the credits.

Tax Credit (EITC) help families with the fewest resources fill the gap between income and expenses by providing cash when they file their taxes. During the pandemic, temporarily expanded federal tax credits helped bring 10,000 people out of poverty. Unfortunately, when these credits ended, many Vermont families with children were worse off. Vermont has been a leader in state-level anti-poverty tax credits, but restrictions on who qualifies, as well as systemic barriers to access, leave out many Vermont families who would benefit from the credits.

The Alliance supports the efforts of the Anti-Poverty Tax Credit Coalition to expand the Vermont EITC from matching 38% of the federal EITC for families with children to 55%, and to expand access to the Vermont EITC and CTC for families with low income who need them most. These changes will reduce poverty, improve family financial stability, and allow Vermonters to meet needs specific to their families.

Lead Organization: Public Assets Institute

Data and Talking Points

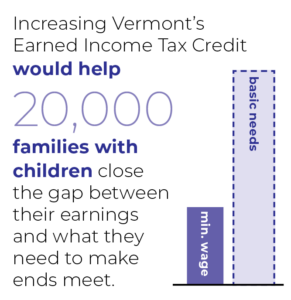

- Increasing Vermont’s EITC would help 20,000 families with children close the gap between their earnings and what they need to make ends meet.

- While the CTC and the EITC help to lift many families above the poverty level, they are still well short of the $70,000-plus per year needed to meet their basic needs.

- Families with children six and older don’t get the state CTC, so they have still fewer resources.

Resources

Session Results

Result: Some improvements secured

Pre-session goal: Expand the Vermont EITC from matching 38% of the federal EITC for families with children to 55%, and expand access to the Vermont EITC and CTC for families with low income who need them most, in order to reduce poverty, improve family financial stability, and allow Vermonters to meet needs specific to their families.

The Governor’s FY26 Recommended Budget included an expansion of the Vermont Child Tax Credit (CTC) by one year, to include children ages six and younger. While it also included a proposal to expand the Earned Income Tax Credit (EITC), unfortunately the proposal did not apply to families with children. Both the House and Senate supported the Governor’s proposals and included them in their FY26 Budget.

The proposals were placed in statute through S. 51, which is scheduled to secure final passage during the Legislature’s supplemental session in mid-June. The bill also includes a technical clarification about who is eligible for CTC.